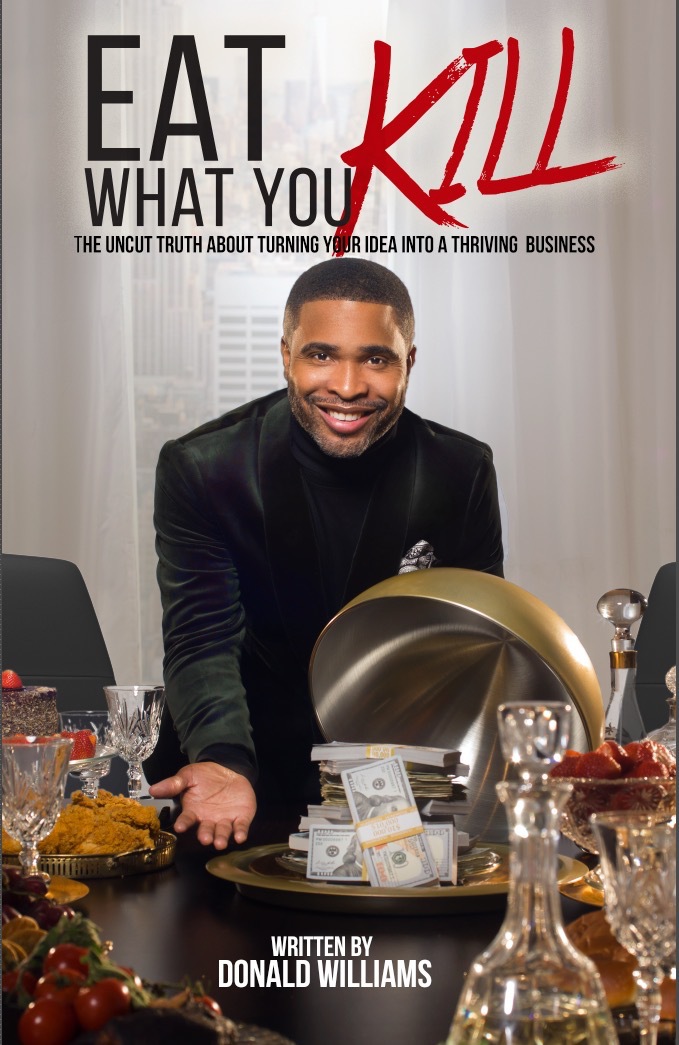

( ENSPIRE Man Code 101 ) Donald Williams’s New Book Eat What You Kill Details His Inspiring Journey To Become a Small Business Consultant

ENSPIRE Contributor: Anastasia Hanna

Donald Williams is a small business consultant and author. He exchanges tips on personal finance, taxation, PPP, and small business finance and startup as a small business owner. He is committed to assisting people with similar backgrounds in his community in achieving financial independence.

Eat What You Kill is a memoir of his corporate triumphs and failures. He wrote this book to help those who want to start a company avoid the same pitfalls he did. It’s a hands-on guide that, if followed correctly, will transform the way you develop your company for the better.

A revolutionary. A wealth creator. A financial specialist. Donald Williams is dedicated to assisting individuals, small business owners, and startups in identifying and establishing the financial base they need to succeed. An industry he enjoys has fueled Williams’s career, with a Bachelors in Arts degree in accounting from the Southern University of New Orleans and Masters of Arts honors degree in accounting from Clark Atlanta University. Williams Accounting and Consulting (WAC) was founded in New Orleans in 2005. He opened his second location in Atlanta less than a year later. To date, he has amassed a clientele of over 1,000 people and companies throughout the United States.

Williams is a seasoned entrepreneur who knows the difficulties that small business owners face. They have systematically designed WAC to directly and efficiently support this demographic, as well as individual personal finance needs. Williams, a market smart CEO, has established a company that manages his clients’ challenging banking, accounting, and tax filing planning. Clients of WAC will concentrate on enhancing their organizations and investing in their personal lives by relieving strain.

Williams established Suivant Consulting in addition to WAC. His consultancy firm assists people in actively transitioning into entrepreneurship.

ENSPIRE Magazine interviewed Williams to explore the motivation behind his business and his book, some financial tips for children, couples, and starting a business during the pandemic, and much more!

What influenced your decision to major in accounting? Why are you passionate about this industry?

Accounting is the language of business. Every business, small and large, and regardless of the industry, uses accounting. I knew that I wanted to start and build businesses, so I needed to learn about accounting. After I started working in the accounting industry, I soon realized that the accounting industry was going to enable me to work with thousands of businesses, which prompted me to start and build Williams Accounting & Consulting. I’m passionate about the accounting industry because it allows me to advise and support a very broad and diverse group of businesses.

I understand that your book “Eat What You Kill” details your business struggles and success. Do you think your struggles were just as important as your success in getting to where you are now? Why or why not?

I definitely think my struggles were just as important as my successes. In order to succeed in business, an entrepreneur needs to be able to persevere through struggles. By persevering, the entrepreneur gains confidence, skills, and an understanding that the entrepreneur needs to work hard and work smart. Although I have a great support system of family and friends, I did not have anyone financially backing me as I started and built Williams Accounting & Consulting. I had to figure out how to make money and invest the money. I had many struggles, but through perseverance, I came to understand that I have the energy and drive to make money, regardless of the circumstances.

Regarding your book “Eat What You Kill” why did you feel that now was the best time to write a book about your experiences?

I’ve been advising clients for over than 20 years. I see many of my entrepreneurial clients struggling with the same issues I experienced. My entrepreneurial clients have great energy and drive, but do not have anyone to mentor them and tell them how to operate in order to be successful. My hope is that “Eat What You Kill” is just the first of my future publications that will allow me to support entrepreneurs and other business owners as they build their businesses.

What would you say is the value of financial literacy?

Through financial literacy, a person learns how to make money work for them instead of always having to work for money. For example, when a person earns $10 and then invests that $10, the $10 will generate interest and dividends, which will then compound into more interest and dividends, resulting in the person converting that $10 of savings into $1,000 of savings, without having to work for any of the money after the original $10.

In contrast, when a person earns $10 and then spends it without investing it, then the person will have to work hard to make all the money after that first $10 in order to have $1,000. Even worse, when a person has to take on interest-bearing debt at high interest rates, then the person has to work very hard just to pay off their interest and debt, and as a result, the person does not even get a chance to enjoy any of the money for themselves. Financial literacy enables a person to focus on investing money instead of borrowing and spending money.

What are some simple ways to build financial competence in children and young adults?

Invest in the stock market! Even if they just own one share of stock in a company, it’s a start. By having stock in a company, they will learn about stock investing, generally, and the company they are investing in. This creates a great educational opportunity while also having an investment that probably increases in value. It’s also important to teach young people that credit cards should only be used for essential purchases unless and until all credit card balances are completely paid off. Only when this complete payoff has been accomplished should non-essential purchases be allowed while using a credit card.

How would one go about building a business with their significant other?

Even though an entrepreneur may be going into business with their partner, they still need to put a written agreement in place between the two of them regarding their respective work expectations for each other and for the management of the business. Specifically, regarding the management of the business, the couple should outline which decisions each one could make without consulting with the other and which decisions will require both of them to agree. They should also put in place a detailed budget that would be reviewed and updated once a month to make sure they are using their money as planned.

What are your thoughts and tips on starting a business during the pandemic?

With vaccinations now well under way, with significant stimulus from the federal government forthcoming, and with low interest rates in place, this is a great time to start a business. There is a lot of money available now from friends, family, and local investors, to help an entrepreneur start a business. To be properly financially prepared, an entrepreneur will want to carefully prepare a detailed expense budget as well as develop written plans for making their business successful. Engaging a good accountant and a good attorney early will make the process more efficient and effective and much less stressful.

What are the top five mistakes people make when filing their taxes?

Taxpayers make a number of mistakes when filing their taxes. These mistakes are avoidable. The biggest mistakes?

- They fail to claim valuable tax credits and tax deductions. Many taxpayers elect to take the standard deduction even though they would pay much less in taxes by itemizing their deductions. Other taxpayers miss credits and deductions for eligible dependents, health care expenses, interest expenses, home business expenses, and vehicle expenses. Many states also offer credits and deductions as incentives that taxpayers fail to recognize.

- They fail to keep good records to determine and validate deductions. Deductions are only available to the extent that they can be proven to the IRS or the state tax authority, so even if a person is eligible for a deduction, they will not be able to benefit from it without supporting records.

- They provide incomplete records to their tax preparer. Even if a taxpayer maintains good records to determine and validate deductions, those records become worthless if they are not provided to the tax preparer because the tax preparer will not know that such records exist.

- They fail to pay estimated taxes throughout the year. Self-employed persons and businesses need to pay estimated taxes throughout the year, otherwise, a large tax bill will be due in the spring along with tax penalties and interest.

- Lastly, many taxpayers will file their tax return late as a result of not requesting a tax extension. If a person is unable to file their taxes on time, then they need to timely request a tax extension. All of these mistakes can be avoided by engaging a competent tax preparer and then communicating with that tax preparer on a regular basis throughout the year.

What inspires you in your daily life? How do you maintain a positive outlook?

I love helping other people. I love advising them in business, and I also love supporting them emotionally and sometimes financially. Helping another person thrive is one of the greatest pleasures in life. Life can be very hard, and staying positive is challenging, but I have found that when I am focused beyond my own interests, and helping those around me, I feel good about myself and have an easy time maintaining a positive outlook.

What would you say is the most important lesson you learned in your life and in business?

The most important lesson that I learned in my life and in business is to never quit on myself. Even though I may make mistakes, struggle, and lose my way, I am blessed with all the talent and ability that I need in order to overcome my mistakes and struggles and to find my way. I believe that this same lesson applies to all of us. We just need to be willing to put forth the effort to be who we want to be, but that effort is always worth it.

Finally, what is a good tip to remember when you’re striving to reach your goals?

When you are striving to reach your goals, you will need to invest a lot of your energy to each step on your path to reach the goals, take a positive outlook and approach to each step, and believe that each step is an opportunity instead of a burden.

To learn more about Williams or buy his new book, visit his website!