( ENSPIRE Feature ) Financial Courses Offered for Unprepared Black College Athletes to Close the Financial Literacy Gap

ENSPIRE Contributor: Matthew Carbonell

College is always seen as the go-to route for extending education and providing opportunities to kick off a stable career. However, a recent study reveals that almost half of 30,000 college students still feel unprepared to manage their finances. This issue is particularly found among Black college athletes. These students often lack access to financial literacy resources compared to their fellow college classmates. As a result, a financial literacy gap is created that puts many Black college athletes at a monetary disadvantage.

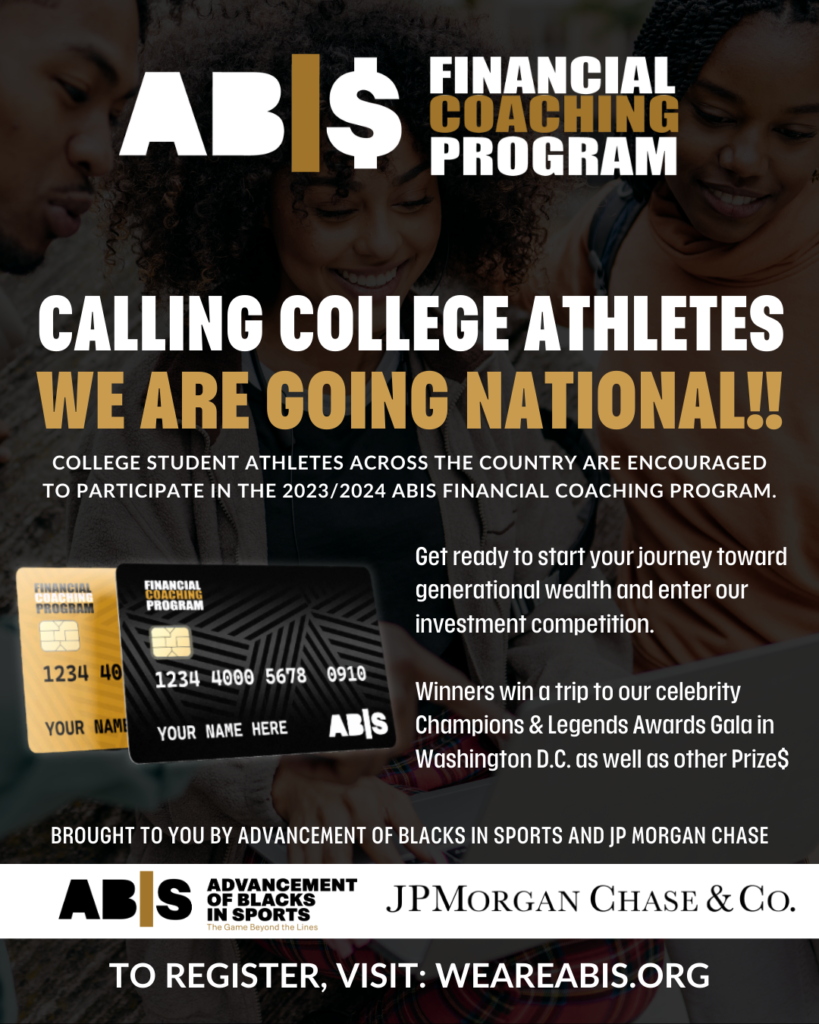

To bridge this gap, Advancement of Blacks in Sports (ABIS) has partnered with one of the most prominent financial institutions, JPMorgan Chase. Together, they offer free financial courses tailored to Black college students. On top of this, these courses are supported by the Association of African American Advisors (AAAA). Taking these courses helps by providing essential knowledge on important practices like money management and wealth-building during the undergraduate years.

Advancement of Blacks in Sports was founded a little over three years ago by Gary Charles. Gary was deeply moved by what was happening across the country. He was driven by both the Black Lives Matter movement and the racial injustices that were impacting society. Thus, ABIS was born and so was the financial coaching program.

To provide insights, Gary Charles answers how the financial coaching program can help students and families. Jeanique Druses, the Northeast regional executive of global philanthropy of JPMorgan Chase & Co. also provides some supporting answers.

What are the financial literacy sources that Black College Athletes can not access in particular?

Shockingly, most young Black athletes don’t know how to manage their money. That’s because they were never taught essential basic money management skills. The resources are out there but they are not reaching Black and Brown communities as urgently as other communities. As a result, the majority of these athletes end up living paycheck to paycheck or completely broke only a few years after retirement.

Also, Black people make up less than three percent of financial planners in the country. Because of this, we aim to educate Black students about financial planning and money management much earlier in life. Some of our Financial Coaching student-athletes cohorts major in finance/economics with a desire to be wealth managers. Though this is great news, ABIS will continue to be that necessary resource for Black athletes. This will give Black college athletes the skills and behaviors for financial health, generational wealth, and financial security for their future selves.

What specifically would these courses be teaching?

The ABIS Financial Coaching program sponsored by JPMorgan Chase has a curriculum that educates in but is not limited to, the following areas: Budgeting, Saving, Understanding All Aspects of Credit, NIL (Name, Image, Likeness), Stock market Investment, and more.

Another major part of the program is that we make it mandatory for each collegiate athlete to take advantage of the opportunity to meet with an ABIS personal financial planner (which we call a financial coach) for FREE.

What exactly are money management, sustainability, and wealth-building?

Money management is all about handling one’s finances by budgeting, saving, and investing. Sustainability is avoiding excessive debt, and making responsible choices. Young athletes who sign big pro contracts often wind up making expensive purchases. It’s because they’ve never had that much money before and don’t know what to do with it. Wealth building is about smart investments and long-term planning. It helps preserve the money over time for a secure future. – Gary Charles

“These all ladder up to financial health and the shrinking of the racial wealth gap, in line with ABIS’ mission to infuse equity into sports. Through Financial Coaching, a foundation is laid that helps those coaches adopt successful money-management habits. This maximizes the utility of their financial resources. They obtain the basic skills necessary to direct their finances, enabling them to cover their needs and build wealth to benefit their futures.

Financial coaching goes beyond basic financial literacy training. It is a hands-on approach that helps the recipient of coaching to implement financial management concepts into their everyday lives. To borrow from the old proverb, they are taught to fish to feed them for a lifetime.” – Jeanique Druses

Would you say that because of the current economic environment, these courses should be prioritized why or why not?

These courses should be prioritized because people are not only living longer, but the student-athletes need to understand that they won’t be making money as athletes their whole lives. Thus, retirement planning for them becomes crucial. Financial coaching not only teaches them practical money management skills but also teaches them the value of money. Ultimately, prioritizing financial coaching contributes to financial stability, and more informed communities since these students can share what they learned with their families and friends.

“It would be a misnomer to call this a course. It goes beyond that. Just as a basketball player needs to pick up a ball, get in the game, and practice his/her skills to become great, the same work ethic applies to managing finances.

We should not expect people to be adept at managing their financial resources by learning in a classroom setting. They need practical application. It is a life skill that no one should be without. Unfortunately for many in the Black community, this isn’t a skill that is taught at home. Also, learning on the job, in the game of life, when stakes are high, and your opportunities limited, is risky.

These student-athletes generate huge profits for their schools. With the advent of the NIL policy, they are finally able to also benefit, some in significant ways from the work they put in on the field, court, or track. Through this program, ABIS is helping them to seize the moment and capitalize on the opportunity.

In line with the JPMorgan Chase Racial Equity commitment, we thought this was an opportune time to make a strategic dent in the racial wealth gap by investing in campus influencers. Throughout society, Athletes are looked up to and if they think managing their finances is cool, there could be a positive spillover effect on the entire campus community. That is why JPMorgan Chase thought it was important to co-create and fund the launch of the program with ABIS. It was necessary to lend employee hours and expertise to the cause.

Our team of community managers works with ABIS to provide basic education before the student-athletes start coaching and investment training. We continue to look for ways to provide more value. However, this is bigger than JPMC. More organizations should support the novel work of ABIS if they are truly looking to make a change.

Recognizing that this moment in any student’s life is transformational, JPMC also supports other programs that embed financial coaching into the schools themselves to benefit all students. We welcome other funders to join us in these efforts. The athlete’s situation is unique, so a tailored approach that speaks to their specific situation is necessary.” – Jeanique Druses

What is the difficulty level of these courses, how flexible would it be for a student’s schedule?

These courses are designed to help with money management for everyday life. So the difficulty level depends on how much the student has been exposed to growing up. As we all know, everyday life is not the same for everyone. Some find it more difficult than others.

We know these athletes receive a scholarship to play a particular sport, so we work with their coaches to figure out the best available times they can participate in the courses.

“It’s not about the difficulty level. This is the game of life where the lessons get harder as you get older and assume more responsibility. The wonderful thing about financial health and financial coaching is that it begins and ends with the person receiving the coaching. Financial coaches meet a person wherever they are on their financial journey.

The person directs the work to develop their goals, they achieve the outcomes, and the coach is there to provide feedback and accountability. You are never too young or too old, you are never too wealthy or too low on funds to participate in financial coaching.” – Jeanique Druses

How can the things these courses teach aid undergraduates for their futures? What are some examples they could be able to do with this knowledge?

One of my key expressions in life is, ”You don’t know what you don’t know.” Teaching young athletes about finances better prepares them to do things like buy a house at a young age, secure finances for family emergencies in case something tragic happens to a parent, and start building wealth for their future, their future children, and their grandchildren. What ABIS would love to see them also do is pay it forward. Help the next generation of Black athletes by teaching them what they’ve learned.

Black college athletes can rest easy knowing that there are resources like these to help propel them into the future. These skills are needed for responsible financial management and long-term wealth generation. So, it isn’t just for the Black college athletes themselves, but also their families and their family’s families down the line. These ABIS financial courses sponsored by JPMorgan Chase prepare students for future money troubles so that they can secure more prosperous futures.

Related Articles: Schelo Doirin Provides Black Women Financial Freedom through Black Women Invest, Financial Literacy and Racial Equity Enhanced in College Sports