( ENSPIRE Community Spotlight ) Learn How the Young Generation Can Benefit from Super Money Kids Through Mastering Financial Literacy

ENSPIRE Contributor: Keith Alexander Lee

Founded by Courtney Hale and his late wife Tia Barbour-Hale, Super Money Kids is a non-profit organization promoting the importance of financial literacy for youth. Since the inception of Super Money Kid, Hale and his organization have helped children across the nation save over $300,000 as well as helped set over 1,000 personal financial goals through their curriculum and banks.

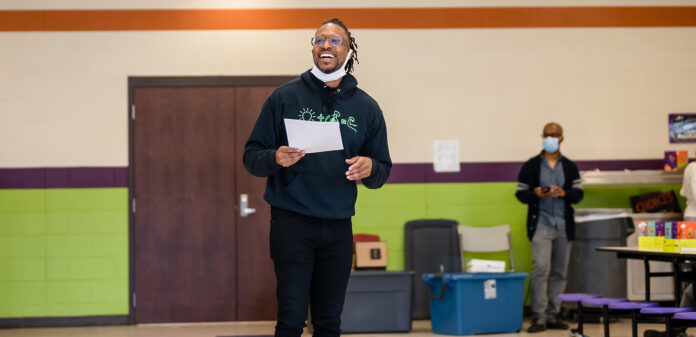

Meet the man behind the organization

Founder Courtney Hale’s family struggled financially throughout his childhood. His parents held clashing views on financial management, the financial strain ultimately resulted in their divorce. When Hale began working in the financial industry, he realized why his family was struggling financially. The problem was not due to his parents conflicting views on financial management. They lacked the access and education to properly execute these financial plans. Now that Hale is a parent, he noticed the lack of financial literacy still plagues many communities around him. The correlation between financial literacy and poverty became very apparent to him.

As a veteran in the financial industry, Courtney Hale leveraged his skills as a financial advisor and analyst to teach the concept of personal finance management to children of color. This revelation gave birth to the non-profit organization we have come to know as Super Money Kids.

Get to Know the organization

Super Money Kids has created a diverse series of programs that caters to students ranging from elementary school to college. With their cornerstone program, Super Money Kids mainly focuses on 3rd to 6th graders. This comprehensive program comes with 2 modules. The first module introduces the 3 S’s in personal finance; saving, spending, and sharing. The second module introduces “baby economics.” The non-profit organization also designed programs for middle and high school students. These programs include building credits, understanding taxes, and payroll deductions, and planning for life after high school. They also offered more advanced programs for colleges and universities, including topics such as understanding student loans.

They designed these programs for schools, and community organizations to integrate financial education targeted at the youth. Besides the Super Money Bank, children can exercise personal finance management everyday to form good money habits. Moreover, the bank guides the youth in establishing their money goals through Guiding Questions for Weekly Money Goals, as well as a ledger for tracking their finances.

Keeping up with the organization

Technology nowadays allows us to purchase something online as simple as a swipe across the screen with our finger. It is important to equip the youth with basic finance management skills. They must learn the importance of money, as well as how to use them responsibly. This is made possible with the amazing financial literacy content and programs offered by Super Money Kids. As the pandemic continued and classes were conducted virtually, Super Money Kids adapted to the situation and launched their digital platform, Super Money Kids Digital.

Super Money Kids are currently in the middle of their Bank Drive Tour where they are donating their Super Money Bank and curriculum to 5,000 students at elementary schools across the nation. The benefiting schools are in Nashville, Memphis, Birmingham, St. Louis, New Orleans, and Chicago. The Bank Drive will reach its last stop at the end of April.

Please visit Super Money Kids to learn more about the wide range of programs they offer!

Follow Super Money Kids on Instagram here.

Related Articles: KidVestors Invest in the Future of Public School Finance Education, Joshua Michael King Hopes to Empower Community Through Education, Savers Village Real Estate Development Empowers Renters to Become Homeowners with Financial Literacy & Investing Program, Jasmine Young And Her Financial Literacy University