( ENSPIRE Business ) Highlighting Brands That Promote Financial Literacy

ENSPIRE Contributor: Cailin Tennis

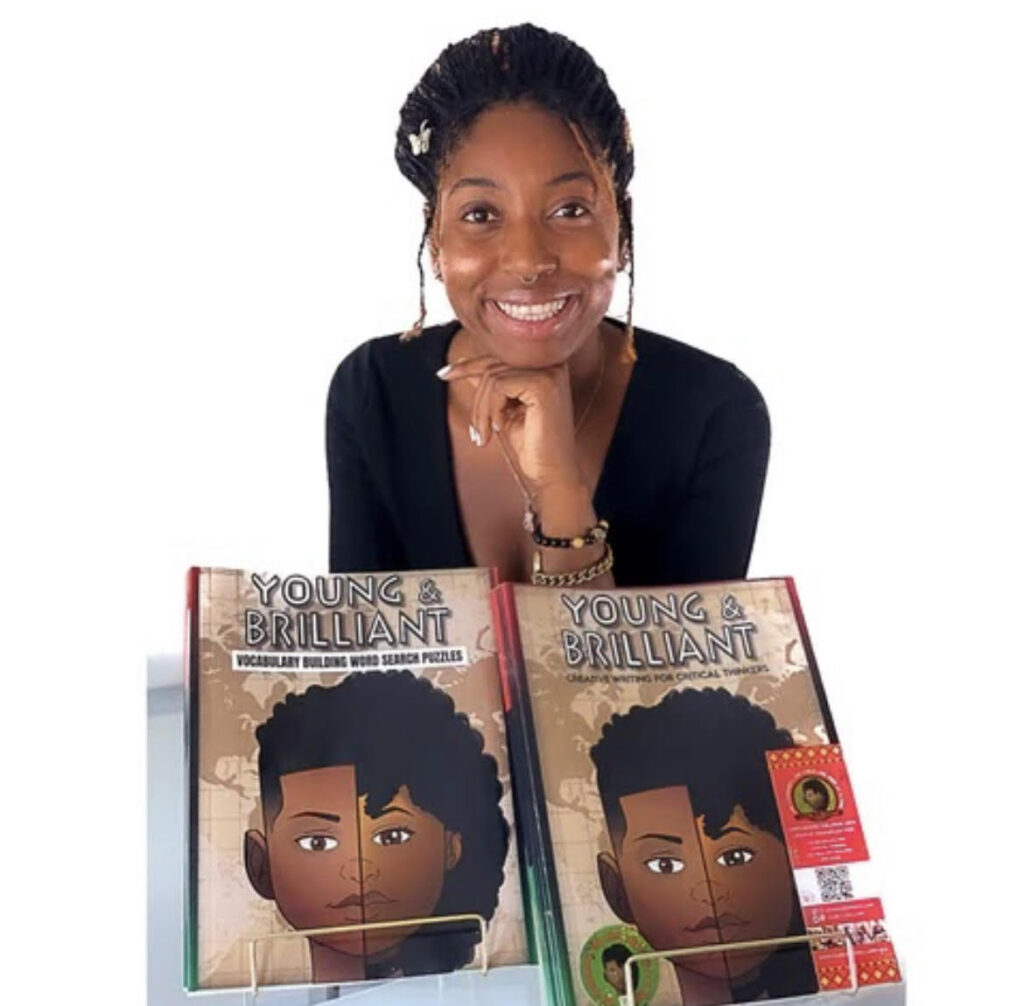

National Financial Literacy Month was in April, so ENSPIRE is highlighting Desiree Faye. Desiree has founded Young & Brilliant to teach children the value of saving, budgeting, and investing. She targets the communication gap between Black employees and others in the corporate world. The foundational issue stems from African American employees not being taught the same critical thinking frameworks as their counterparts, which greatly affects their corporate experience. This issue inspired her to create a foundation to bridge the racial economic wealth gap and provide the missing foundation for our youth.

Desiree’s company, Young & Brilliant, was born during her solo trip to Egypt, where she had an epiphany overlooking the Nile River. She realized that youth need an education that focuses on teaching them the foundations of critical thinking, entrepreneurship, and financial literacy. With their workbooks and puzzles, Young & Brilliant aims to set our kids up for success so they can break generational cycles. By focusing on the racial inequities that exist in our society, Desiree is leading the way in educating our youth to stop the issue at its core.

ENSPIRE spoke with Desiree about what effective financial literacy means, the racial wealth gap, and how building community can bring about change.

Can you define and explain financial literacy and financial responsibility?

Financial literacy is all about understanding the ins and outs of money, such as earning, growing, spending, saving, investing, and utilizing it to build community resources. It’s like having a superpower that helps us navigate the financial world. And financial responsibility? Well, that’s putting that knowledge into action and being the superhero of our own financial lives! At Young & Brilliant, we recognize the significance of these concepts and focus on equipping our youth with the foundational knowledge to become financially literate. This is crucial for building financially healthy adults.

Could you give us an overview of how financial literacy and race intersect?

The importance of financial literacy and responsibility hit me like a bolt of lightning when I stumbled upon a mind-boggling statistic. Get this: it’s projected to take a whopping 228 years to bridge the racial economic wealth gap for African-American families, and 85 years for Hispanic families. Can you believe that? That’s like two to three generations of families struggling to break free from the same cycle of poverty.

Don’t just take my word for it. Instead, dig deep and do your research. Did you know that only 17 states require teaching financial literacy before high school graduation? If money makes the world go round, our kids deserve to know how to spin it right. It’s our responsibility to give them that head starts and set them up for success to be financially literate critical thinkers.

How did your trip to Egypt inspire you to start this foundation?

It was late 2021, and I was on a solo trip to Egypt after being put on FMLA by my doctor. I was suffering from depression and burnout from chasing this idea of “success” that society had defined. Overlooking the Nile River in Aswan, I remember crying and having a heart-to-heart with God asking for clarity on what my purpose was. Amid that stillness, I heard “Pour into the youth.” At that moment, I didn’t fully grasp the significance. Later, as my trip unfolded, the whispers grew louder and eventually led me to quit my six-figure job and build the foundation of what is now Young & Brilliant.

My mission is to bridge the education and wealth gap by teaching our kids the same critical thinking skills that top consultants get paid big bucks for. Yet, it needs to happen in a way that’s fun, simple, and applicable to everyday life.

What demographic of students do you see most benefited by the foundation?

The stars of Young & Brilliant are the students in underserved communities that remind me of my upbringing. These are vibrant communities filled with talented Black and Brown children who often go unnoticed and underestimated. But let me tell you, they’ve got that sparkle and magic just waiting to be unleashed! Growing up, I had the privilege of being mentored by an incredible Black woman entrepreneur who defied the odds. She rose above poverty, just like me, and became a first-generation college graduate with a math degree—the same one I was chasing. It was a game-changer.

That’s why I believe representation is a game-changer, too. Our kids need to know that they are brilliant and capable, no matter where they come from. They need role models who look like them, and who’ve walked a similar path, to show them the way. Because when they believe in themselves when they have that guidance, there’s no limit to what they can achieve!

What are some solid resources you would recommend to those just discovering financial responsibility?

When it comes to introducing financial responsibility to our youth, it’s all about starting small and building money muscles over time. It’s as simple as making time at the grocery store a fun adventure for your kids. Let them be your budgeting buddy, helping you make smart choices and comparing prices. It’s like a superpower in action! Try setting some saving goals together. Maybe they want a new video game or iPad! If this is the case, teach them the responsibility of saving up for something they truly want.

Finally, don’t forget the power of conversation. We know that it is hard for families to have these types of conversations, especially when many of us are still figuring out how to be financially responsible. This is why we created our workbooks – to teach them how to critically think, be financially responsible, and how to build a business. Every little step counts in building that solid foundation of financial knowledge.

All in all, Desiree is an accomplished financial expert who is paving the way for generations to come. Her dedication and commitment to such an important cause are exactly why ENSPIRE is delighted to promote her story and her brand. She embodies the idea that with positive values, role models, and education, anything is possible. Visit Young & Brilliant on the web to start learning more about financial literacy for yourself and our future generations.

Related Articles: Cocktails & Credit, A Financial Literacy Tour, Jasmine Young And Her Financial Literacy University